15+ Simple mortgage

A typical two-year fixed deal has gone up from 234 per cent in August 2020 to 395 per cent today. Forget 15 an hour.

15 Versus 30 Year Fixed Mortgage Buckhead Home Loans

July 25 2022 April 15 2021 by Jenni.

. Job searchers want at least 20 data show In a hot labor market and amid high inflation job seekers want more money from their employers. If youre married you cant file a joint gift tax return. Credit age aka credit history is the age of your oldest account not how long youve used credit.

Credit age makes up 15 of your score. If a person. See your credit history and the ages of the oldest and newest account on your credit report card.

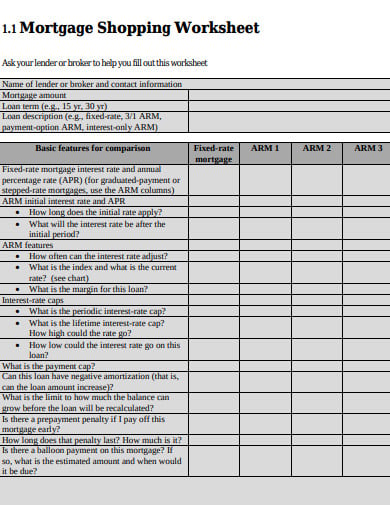

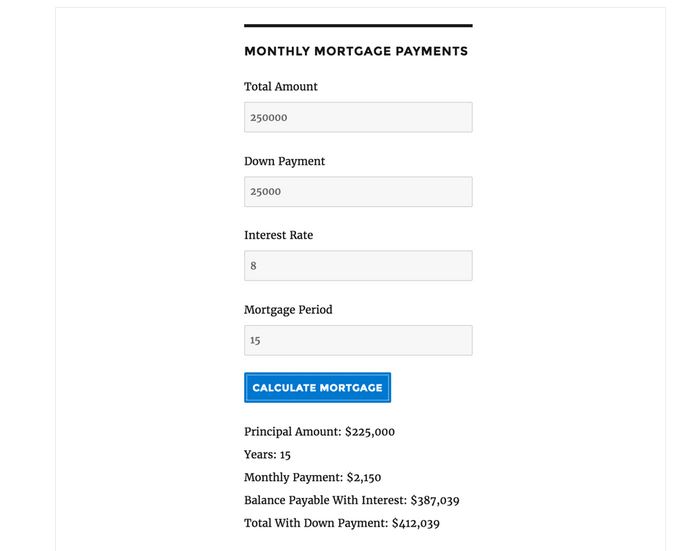

Each spouse must file a separate return if he or she makes any taxable gifts. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. Calculate loan payment payoff time balloon interest rate even negative amortizations.

Another reason to aim for 20 down. Fee simple and fee simple absolute are often used interchangeably. You can however choose to split gifts with your spouse.

Credit age aka credit history is the age of your oldest account not how long youve used credit. Know your credit age. This would leave 176000the amount a home buyer will need for the mortgage.

Almost any data field on this form may be calculated. 10 or 15 10 or 20 10 or 30 15 or 20 15 or 30 20 or 30. Creditors want older credit histories.

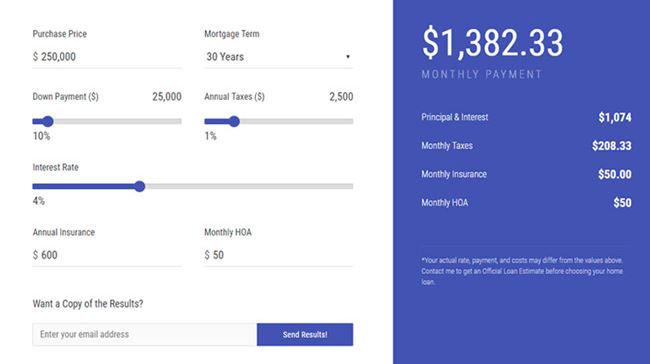

After close to two years it should surprise no one many are at the least tired of this horrendous pandemic or even far - more fatigued and sick - and- tired of it and the impact on our lives. For fixed-rate mortgages the term tells you the precise number of fixed payments needed to pay off a loan. Your property taxes homeowners insurance and in some instances even your homeowners association HOA fees.

This post may contain affiliate links. Fee simple absolute is more powerful than fee simple defeasible because it is outright ownership with no restrictions. Read unique story pieces columns written by editors and columnists at National Post.

56 76 106 ARM 15 20 and 30 Year Fixed Non-Warrantable Condos may be considered. Credit age makes up 15 of your score. Free up money for later in life.

20 of 220000 44000 down payment. Refer to the Legal Reference Guide for Revenue Officers IRM 5172 Federal Tax Liens to determine priority of the Notice of Federal Tax Lien. Youll avoid paying private mortgage.

As time progresses more is placed toward principal but it takes years before the interest and principal are equal paid. For instance 30-year FRMs require 360 monthly payments while 15-year FRMs require 180 monthly payments. In the beginning a large portion of your payment goes to interest.

Encumbrances can be verified using internal sources online research and external sources. See your credit history and the ages of the oldest and newest account on your credit report card. The typical mortgage lasts 15 to 30.

Many mortgage lenders hold money that youve paid in an escrow account to cover three things. Fee simple defeasible and fee simple absolute. If youre tired of renting and cant swing a 15-year mortgage then a longer-term.

Monopoly Mortgage Rules A Simple Explanation. As an Amazon Associate I earn from qualifying purchases. As long as you make payments within the agreed term your mortgage should be paid off by the due date.

Down Payments Property Mortgage Insurance. We compare an escrow to a referee in a football gamethe neutral third party who takes no sides and makes sure everyone is following the. Writes I just switched my 30-year home mortgage to student loan Follow me for more financial advice I have been fielding questions abou.

We offer a number of calculators that makes it easy to compare 2 terms side-by-side for all the common fixed-rate terms. Brets mortgageloan amortization schedule calculator. Many people cant afford the higher monthly mortgage payments that come with a 15-year loan.

Creditors want older credit histories. Paying back the mortgage later If the new owner doesnt immediately unmortgage the. Get in-depth analysis on current news happenings and headlines.

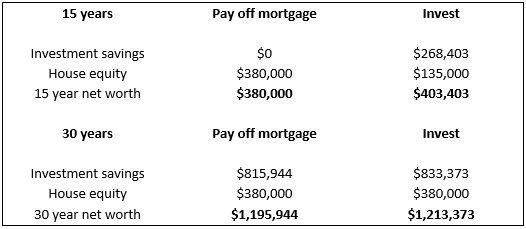

And older accounts are better for your score. Depending on the loan amount interest rate and original term paying the mortgage early can result in significant savings. Unless you plan to move in a few years the 15-year is the way to go.

Know your credit age. People typically move homes or refinance about every 5 to 7 years. For example lets assume you have a 200000 fixed mortgage for 30 years.

If you click one I may earn a commission at no cost to you. Some Dangers From Pandemic Fatigue. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

And older accounts are better for your score. At the bottom of each calculator is a button to create printable amortization schedules which enable you to see month-by-month information for each loan throughout. With a construction loan from Mann Mortgage youll gain access to our collaborative cloud-based construction loan software which simplifies communication between you the builder 3rd-party inspectors and title companies.

Simple Mortgage Payment Calculator This calculator allows you to calculate monthly payment average monthly interest total interest and total payment of your mortgage. If you extend your Form 1040 tax return filing to October 15 the extended due date also applies to your gift tax return. Build home equity much faster.

Thats because there are two main types of freehold estate. If your mortgage deal is ending within the next six months you can apply now to lock in a deal. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then.

With a second mortgage loan you get to finance the home 100 percent but neither lender is financing more than 80 percent cutting the need for private mortgage insurance. More from MoneyWatch. But there is a slight difference.

Luxury Mortgage Wholesale helps brokers navigate NON-QM jumbo lending with simple flexible and straightforward solutions. Mann Mortgage is proud to offer stick-built contruction loans which give borrowers a better option for building the home of their dreams. See IRM 51516 Internal Resources and Online Research and IRM 51517 External Sources.

From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration.

11 Fixed Rate Mortgage Template In Doc Pdf Free Premium Templates

4 Real Estate Calculator Plugins For Wordpress Wp Solver

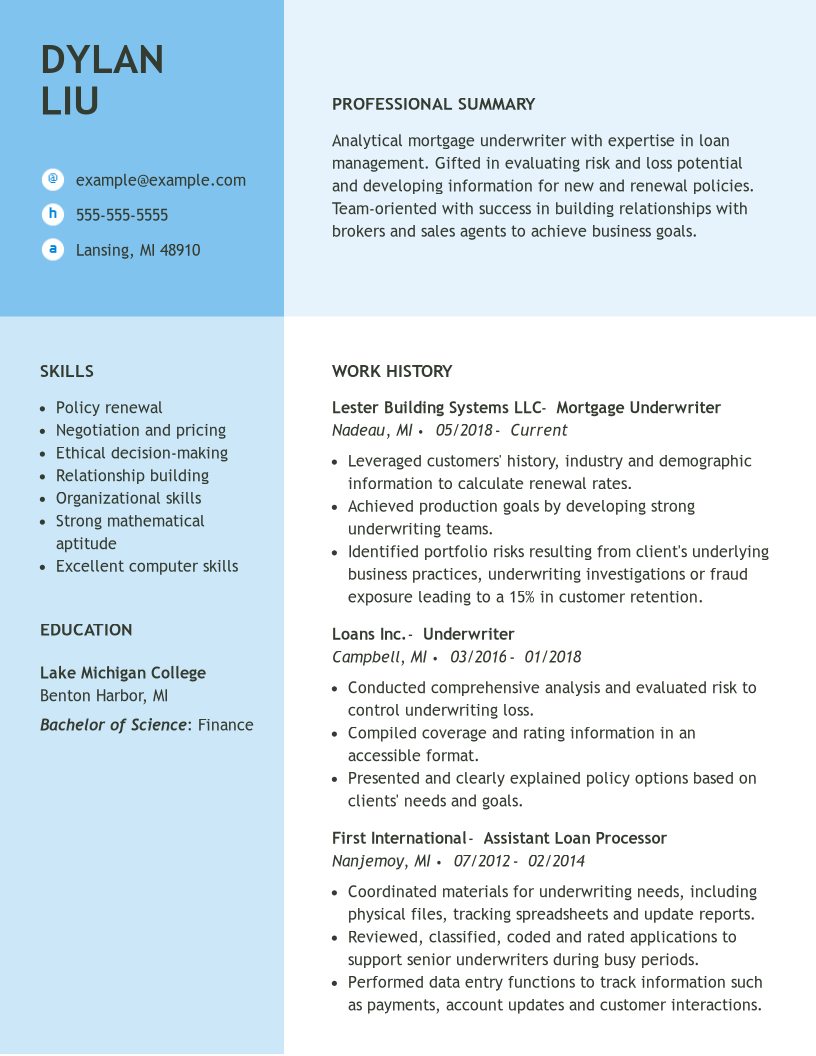

Mortgage Resume Samples Velvet Jobs

Get The Home Loan Process Started With Herring Bank

Loan Calculator Templates 7 Free Docs Xlsx Pdf Loan Calculator Car Loan Calculator Loan Payoff

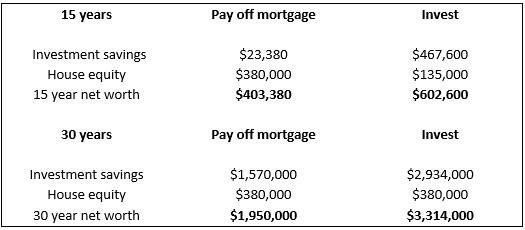

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Mortgage Payment Calculator Refinance Calculator Closing Costs Calculator More

Get A Home Loan A Partner To Help You Every Step Of The Way

2022 Mortgage Underwriter Resume Example Myperfectresume

Seattle S Mortgage Broker Home Facebook

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

15 Professional Wordpress Mortgage Broker Website Template For 2020

Second Home Loans And Vacation Home Loans Summit Credit Union

Bill Wolfe Big Valley Mortgage

4 Real Estate Calculator Plugins For Wordpress Wp Solver

Mortgage Broker Roswell Ga Home Loans Buckhead Home Loans

2022 Mortgage Scams How To Avoid Them Rocket Mortgage